One of the most important questions for an entrepreneur is “Why is now the right time for this idea? Didn’t others try previously and fail?”

There are rarely new ideas in startups. If you have an idea, someone probably already tried it and failed — maybe they mis-executed, there was something counter-intuitive about the customer or business model, or they were too early (correlated with the market not being big enough yet). If you assume other people are smart, which is generally a good practice, then they executed well and there wasn’t anything counter-intuitive going on.

Earlier startups were likely just too early. So if you can’t point to an obvious misstep in prior attempts, “why now?” is often the critical question to answer.

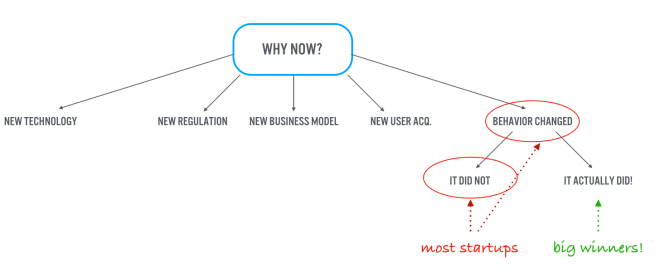

There are at least 5 classes of good answers to why now:

- new technology allows products that simply weren’t possible before, e.g. battery tech and electric cars

- new regulation, e.g. Obamacare

- new business model has emerged, e.g. advertising could support free content online

- new user acquisition channels, e.g. search/SEO, FB Platform v1

- customer behavior has shifted, e.g. a desire for ephemerality once people understood the consequences of searchable, permanent identity

1 to 4 are strong answers and generally clear cut.

5 is the trickiest. Behavior change is the most common answer I hear startup founders assert around “why now” for their company. If 5 is true, then you win BIG — these are the “It wasn’t true until it was true” sorts of startups. Facebook, Uber/Lyft, and Snap fall in to bucket 5.

The challenge is 5 is the hardest to know looking forward. You can assert it’s true, but it’s easiest to know behaviors/preferences/attitudes changed looking backward.

What this means

If you can find novel solutions to problems because of new technology, regulation changes, new business models, or a new customer acquisition channel, then you can often win big and win quickly.

However, the vast majority of startups assert they can succeed because behaviors have shifted somehow. But the vast majority of these assertions are incorrect. However, the ones who are correct will win big. You can only know if the behavior shifts are real in hindsight, but you have to make educated guesses about these shifts looking forward. And that in a nutshell is one of the hardest challenges of being an entrepreneur or angel investor.

Hi Avichal,

I enjoy reading your posts. One example to consider is the rapid shift from cloud-based music streaming to on-demand music streaming. What was surprising was the substantial increase in average annual spend. For CD/Album sales, average spend was $20/year so it was surprising that customers were willing to spend $10/month.

I suspect the reason is it appealed to a new demographic – younger customers.

Hope you are enjoying your time off.

Patrick

Great example. Thanks for the kind words. Hope you’re well!

This is good. But I don’t think you can discount #6: “We did something hard that others could have done, but didn’t try because they didn’t realize how valuable it would be” (ex. Stripe). And most of all, #7: “We figured out how to do something that no one else ever has” (ex. Google). Limiting the analysis to the five you listed rests on the common worldview that talented people are fungible, that there aren’t ‘great men’ and ‘great women’ who bring unique thoughts and work to humanity, and that there is some kind of efficient market for ideas.

This is not an attack on your post. Most investors operate under your “5 whys” framework, so founders should be able to answer that “Why now” question within that framework. Those founders who dare to do original work had better figure out a way to hide it from most investors. Also I do notice that you said, “There are rarely new ideas in startups”, meaning there are sometimes new ideas. But I think the focus ought to be on those new ideas. And I think the most ambitious investors seek out them out.

Stripe and Google are both great examples but I think they fit in to the five I have. Stripe hit on a massive shift in behavior of developers wanting APIs and having the power to make these decisions bottoms up in organizations, rather than it being mandated top down. Google (Pagerank more specifically) was new tech. I think it’s totally legit for someone to say they’ve invented the new technology that makes certain things possible (Pagerank and some novel crawling + indexing enabled search) and then back it up with real data.

To clarify, I think there could be more than the five I’ve listed out but think the two you’ve called out do fit in to the five I have. Case studies are probably the most interesting example so if you think of a company that doesn’t fit in to these five, let me know and I’ll update the post

This is a cool post – thanks for sharing! I tried this model on a bunch of cases and it seems to work well. Here were two categories of edge cases where it’d be great to get your thoughts.

COMBOS

Facebook: Seems like this might’ve been a combo of relatively new distribution techniques (social) plus new tech (internet penetration on college campuses) on top of behavior change. I.e. many college students may not have had access to both a computer w/ a lan card + high speed internet on campus until the mid-2000’s. Thoughts?

Snap: I wonder if this one is a combo as well. Yeup there was behavior change around privacy but I also suspect 2011 / 2012 was when smartphone adoption among teens started taking off. After the iPhone app store launched in 2008, I suspect it took a few years for teens to convince their parents to buy them smartphones. So there might’ve been a tech timing issue here as well.

NEGLECT

Pinterest: Could this fall into another category of “neglected market”? They came in late on social distribution (2010) and didn’t really fall into the other tech, biz model or regulation categories. It’s also hard to say whether behavior changed significantly because I remember people loving Kaboodle (I think of them as their spiritual ancestor) 5 years earlier. But Kaboodle got acquired and stopped doing things so that left a vacuum in the market.

Zillow: Feels possibly similar to Pinterest. They started in 2006 but I wonder if someone could’ve started this circa 2000 when Amazon and Expedia had already gotten people comfortable shopping for a variety of categories online incl. big ticket items.

Dropbox: This one seems like a combo of new tech (syncing is hard!), biz model (consumer freemium) and neglect. Microsoft acquired FolderShare, which did something similar, back in 2005. I loved FolderShare but it didn’t do much after the acquisition, leaving a big market vacuum. Had they stayed independent, I wonder if the outcomes might’ve been very different.

Robinhood: Some may classify this as good timing due to business model innovation. But my brother was in the finance sector before they started and said people always knew $0 commissions were possible but no one moved on it earlier (possibly because it was easier to make money in lots of other ways in finance?) So this sniffs a bit like neglect.

Credit Karma: Though you could say this was a new biz model, I feel like someone could’ve built credit karma 5 years earlier. I wonder if like Robinhood this was due to neglect in the fintech market a decade back.